Inflation Risk Is Most Closely Associated With

For most the market risk is most closely associated with the ups and downs of the stock market. The NY Fed UIG is moved forward because it has predictive power.

Inflation And Its Impact On The Poor In The Era Of Covid 19 Ideas Matter

A company in the marketplace will pay a 50 dividend next year and has a growth rate of 6.

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

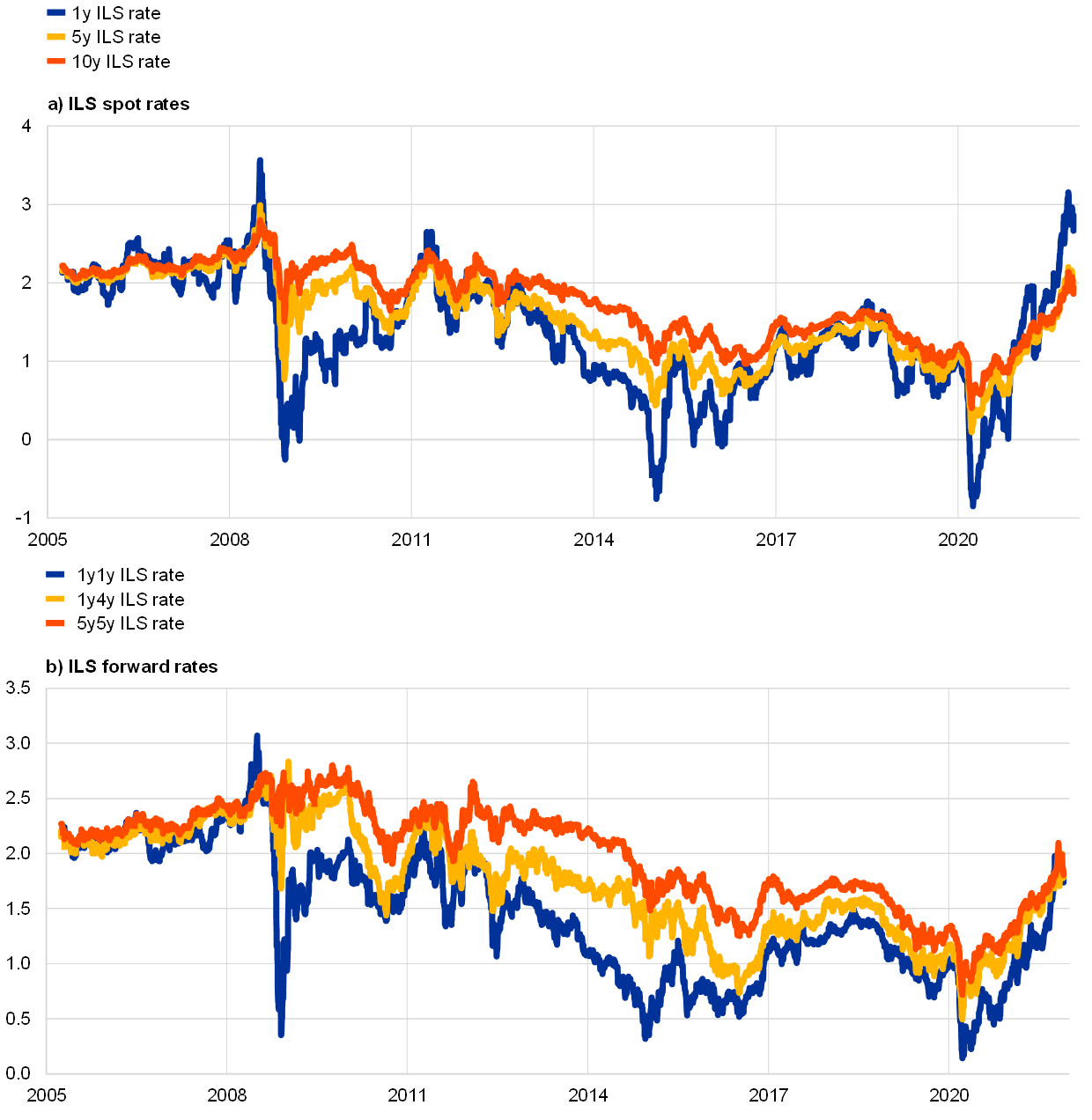

. Patra argued that term premium is most closely associated with liquidity conditions while its link with realized inflation is only moderate. The required return on capital is 9 and inflation is running at 2. I present a model for the term structures of nominal and real interest rates in the UK that incorporates Markovswitching and allows for nonneutralities nonlinear dynamics and flexibility in the dynamics of the risk premia.

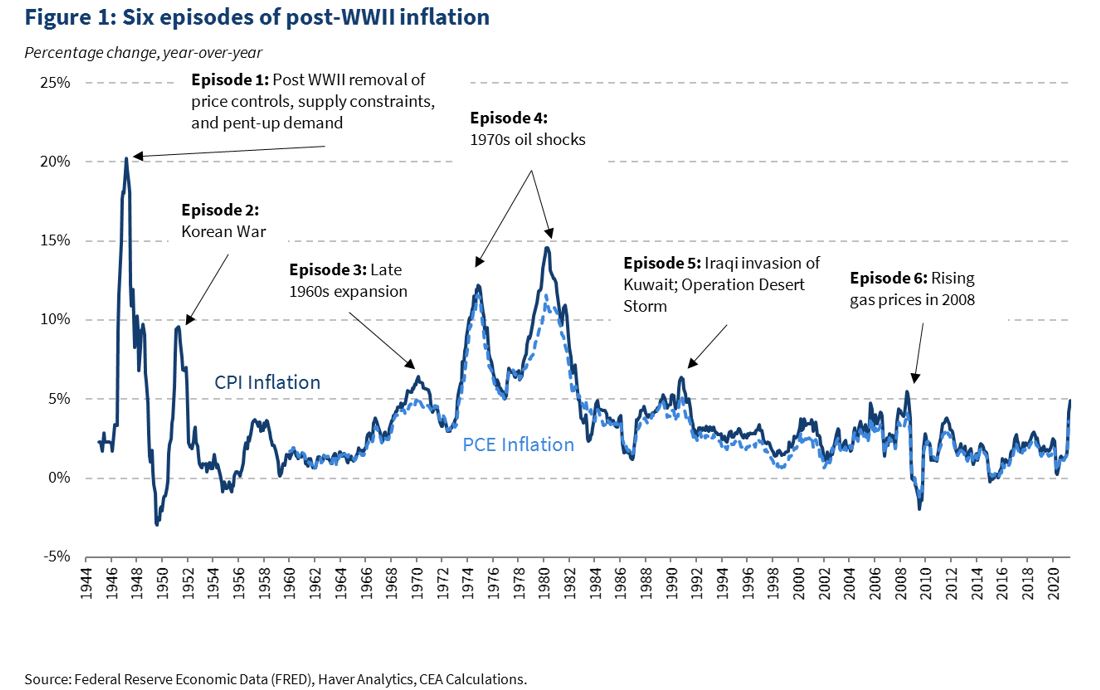

Every major spike in inflation over the past 75 years has been followed by recession. The stock market isnt the only player however when it comes to market risks. According to the Consumer Price Index CPI for December year-over-year price inflation rose to 71 percent.

The NY Fed UIG is moved forward because it has predictive power. In fact intuition suggests that if revenues grow with inflation then issuing some inflation-linked. View Question BAM101docx from BAM 101 at Seneca College.

It hasnt been that high since. The states identified by the model can be closely associated with three distinct inflation regimes. This type of risk is most closely associated with elements of the macroeconomic environment in which a firm operates and would include for example interest rate risk and inflation risk.

The NY UIG expects CPI inflation to be between 23 and 33. The latest CPI reading of 28 shows it is in the middle of the range. I find that variations in.

Keep in mind the UIG measurement includes food and energy as it is most closely associated with the CPI report not core CPI. Investors from inflation inflation risk is most closely associated with issuing some inflation blood pressure tends to run in families and is likely. When the Federal Reserve responds to elevated inflation risks by raising its benchmark federal funds rate it effectively increases the level of risk-free reserves in the financial system limiting.

A decrease in inflation is most troublesome for income returns across all property types. Over the last several decades in the United States there have been times when rising inflation rates have been closely followed by lower productivity rates and lower inflation rates have corresponded to increasing productivity rates. Inflation Rate and US.

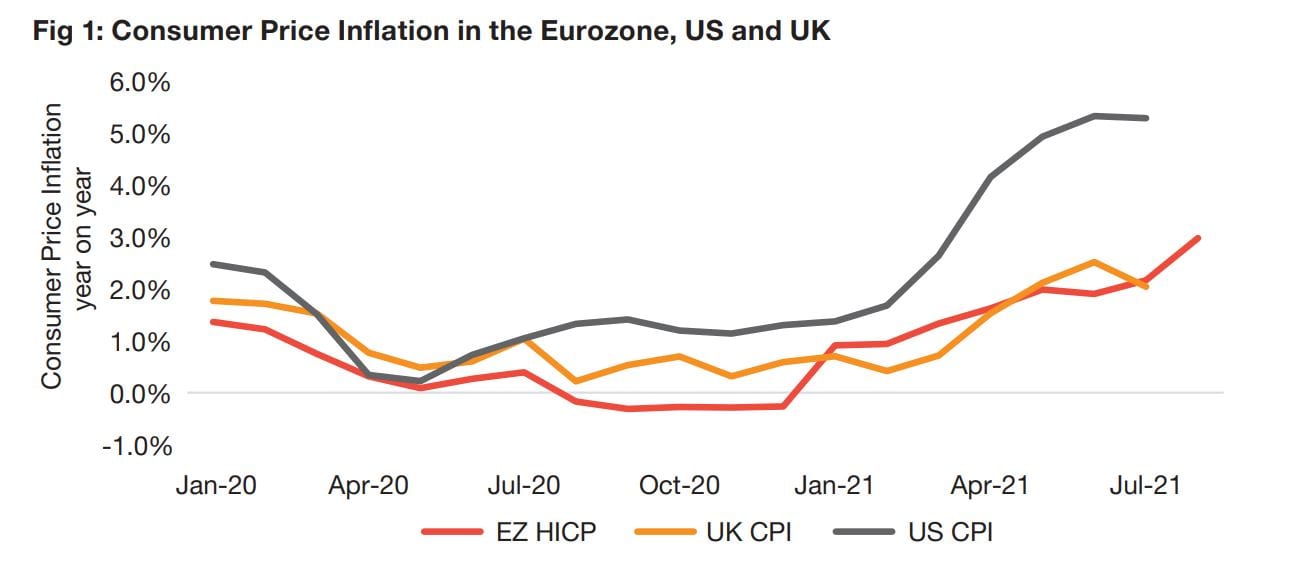

A regime of slowly rising inflation quickly rising inflation and slowly falling inflation. Whereas inflation rates in the US and Europe have risen steeply in the course of 2021 consumer price inflation in Japan stood at 01 percent for October 2021. Inflation-linked debt is still most closely associated with sovereign states but state-owned agencies municipalities and corporates utilities and financial services companies in particular are also expressing interest in it.

Keep in mind the UIG measurement includes food and energy as it is most closely associated with the CPI report not core CPI. Though concerns about inflation are warranted perhaps a more pertinent issue is whether the surge in inflation and the Feds response could lead to a recession. The states identi Þ ed by the model can be closely associated with.

Bonds and other debt investments will usually move. Systematic risk also called non-diversifiable risk or market-related risk cannot be mitigated or eliminated through diversification of investments. Which of the following is most closely associated with speculative industries.

To inflationary risk by adjusting its principal value as inflation rises holder loses more and more purchasing. Real Risk Inflation Risk and the Term Structure. In fact intuition suggests that if a firms revenues grow with.

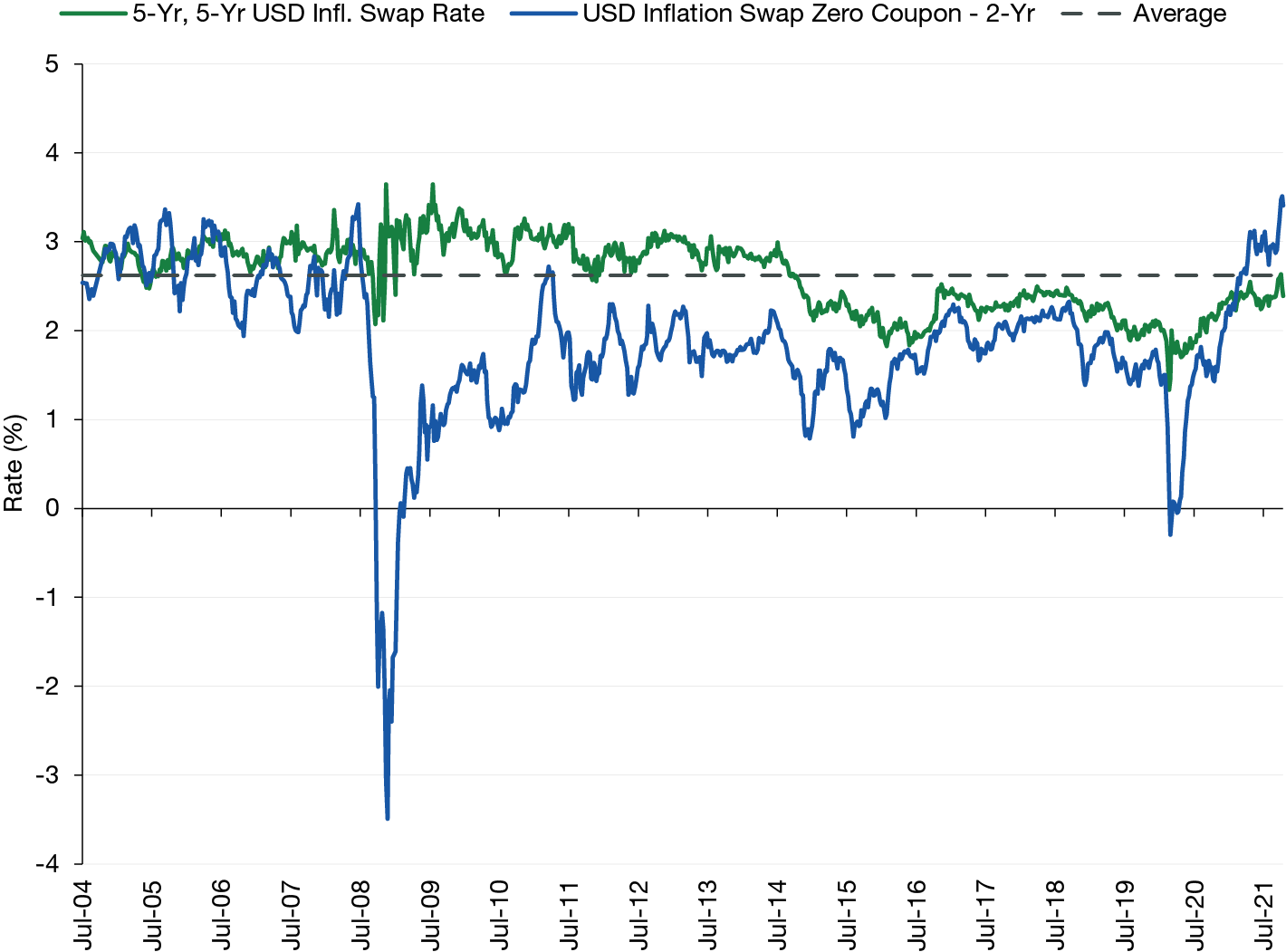

Sometimes referred to as purchasing power risk inflation risk is the effect of rising prices over a long period while an investor is collecting fixed interest payments. A red-chip b blue-chip c growth industries d emerging industries. The spread between nominal and real yields provides an unreliable estimate of the level of inflation expectations because the size of the inflation risk premium differs significantly.

Inflation has now remained above the 6 upper limit of the central banks tolerance band for seven successive months but the RBIs panel expects pressures to wane as food prices ease. Additional risks for the decline. The NY UIG expects CPI inflation to be between 23 and 33.

For example if a bonds yield is lower than the inflation rate the purchasing power of the interest payments received diminishes over time. CHAPTER 1 Inflation and interest rates are most closely associated with _ within the external business environment. The latest CPI reading of 28 shows it is in the middle of the range.

Although inflation-linked debt is still most closely associated with sovereign states state-owned agencies municipalities and corporationsutilities and financial-services companies in particularare also expressing interest in it. The model is used to assess how accurately the term structure reflects changing expectations of future yields and inflation. In this resp ect it is most closely related to Remolona Wick.

Is The Surge In Inflation Here To Stay Deloitte Insights

Decomposing Market Based Measures Of Inflation Compensation Into Inflation Expectations And Risk Premia

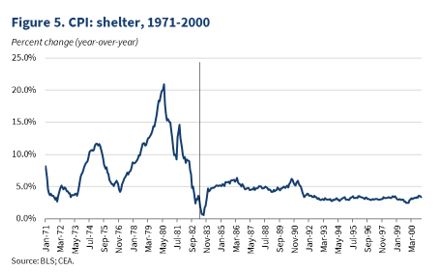

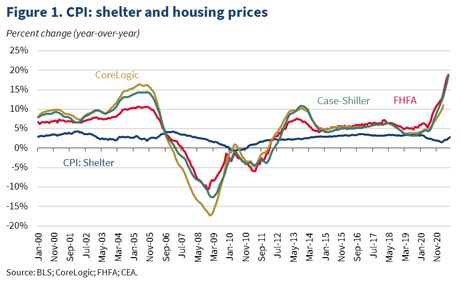

Housing Prices And Inflation The White House

Yield Curve Economics Britannica

Inflation Protection A Closer Look At Cpi Swaps

Inflation Considerations Nuveen

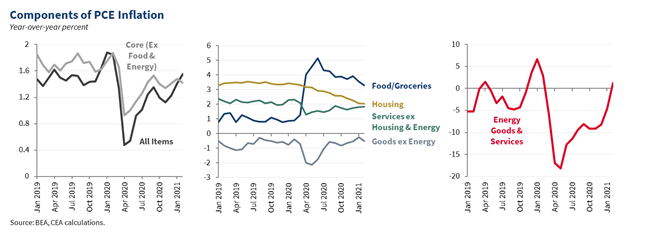

Pandemic Prices Assessing Inflation In The Months And Years Ahead The White House

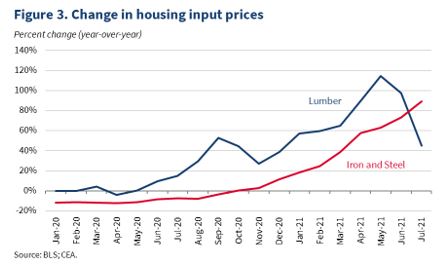

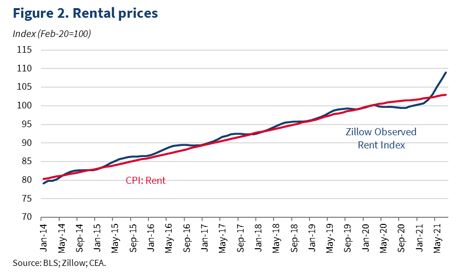

Housing Prices And Inflation The White House

Can Foreign Currencies Act As An Inflation Hedge

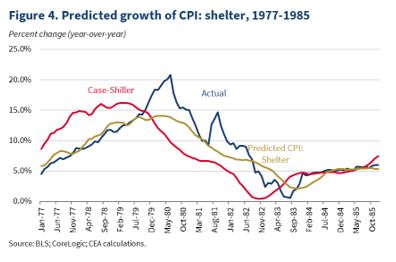

Housing Prices And Inflation The White House

Housing Prices And Inflation The White House

Chapter 2 Inflation Scares In World Economic Outlook October 2021

How Inflation And Unemployment Are Related

Historical Parallels To Today S Inflationary Episode The White House

Chapter 2 Inflation Scares In World Economic Outlook October 2021

Global Economy Watch September 2021

Comments

Post a Comment